NFT Staking and how does it work

What is NFT Staking?

NFT Staking is a way to make use of your NFTs to earn a passive income. An NFT holder will attach one’s NFT onto a blockchain to earn staking rewards. Rewards earned from staking depend on the Annual Percentage Yield (APY), the staking duration, and the number of NFTs staked. This information can usually be found on the platform on which you choose to stake your NFT. This article will cover how to stake your NFTs and some factors influencing their profitability.

NFT Staking mechanism

Staking usually involves a Proof of Stake (PoS) Mechanism. It is a consensus mechanism involving validation nodes and native tokens. To stake a new NFT, randomly chosen validation nodes will propose new blocks to the current blockchain. By successfully adding blocks to the blockchain, the NFT would have been successfully staked and the owner can start to earn a passive income. For a video of how the mechanism works, have a look at this video!

By making use of a PoS mechanism, the blockchain is able to operate without a central authority since blockchain networks do not have a central authority to approve transactions. Moreover, the PoS mechanism uses pseudo-random sequencing to choose validators, ensuring decentralised decision-making.

Why do people stake their NFTs?

NFT Staking is another way for one to use their NFTs to earn a passive income. Many NFT holers prefer to HODL and speculate on the value of their NFTs. This allows one to earn an income from staking as compared to simply keeping the NFT in their wallet.

About HODL

HODL is a term used by cryptocurrency investors who refuse to sell their cryptocurrency regardless of market conditions. This is especially used when investors refuse to sell their coins despite the price drop. It is also known as the abbreviation for “Hold On for Dear Life”, referring to the coins simply not being sold regardless of market price trends.

NFT holders may also choose to pool their assets into a decentralised autonomous organisation to form an NFT staking pool. This works in the same way as shares: the more one contributes to this pool, the more one is able to participate in governance tasks on the platform. This is also similar to peer-to-protocol NFT lending which we wrote about as well. Do have a look for more information!

Factors influencing the profitability of NFT staking

Annual Percentage Yield (APY)

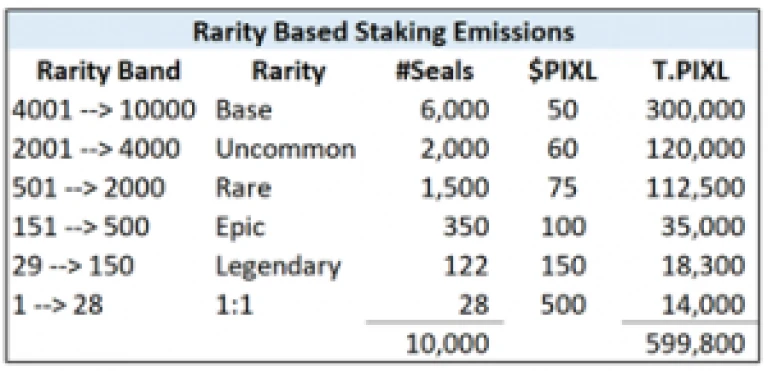

The APY is determined by the rarity of the NFT, and rewards are usually determined by the platform. Some platforms may increase the APY rewards if you choose to stake multiple NFTs, or NFTs of higher rarity. For example, NFT Collection Sappy Seals offers different tiers of rewards for different tiers of rarity.

Chart showing higher staking returns for rarer NFTs

Chart showing higher staking returns for rarer NFTsNFT Collection Price

Understanding the market movements is crucial if one is planning to make a profit. Due to the volatility of cryptocurrency, staking an NFT might be a safer method to hedge against sudden price changes. However, simply selling the NFT when prices rise may be more profitable than simply staking. For more information about understanding price movements, have a look at this video:

Thanks for reading! At Niftyzone, we value your craft and wish to share it with the NFT Community!

Follow our Twitter and Telegram for more updates on our Marketplace.

Feel free to contact us for any further inquiries, or have a look at our FAQ page as well!