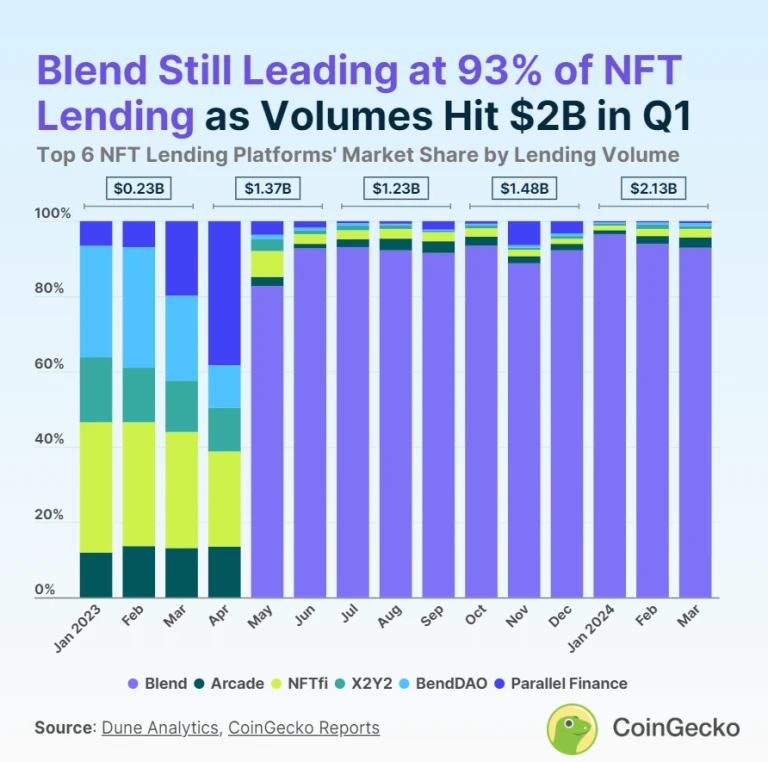

NFT lending volume surpasses $2.1 billion in the first quarter of 2024

According to the latest report from NonFungible.com, the NFT lending market has achieved a noteworthy milestone. In the first quarter of 2024, it exceeded $2 billion in volume, demonstrating a growth rate of 44% compared to the fourth quarter of 2023. This rapid growth is drawing the attention of both investors and NFT holders.

What exactly is NFT lending?

NFT lending involves using non-fungible tokens (NFTs) as collateral to secure loans or borrowing against them. Just like traditional lending practices where physical or digital assets serve as collateral, NFT lending also operates similarly, but with unique digital assets. NFT owners have the opportunity to leverage their NFTs to access liquidity without entirely selling them. The borrower offers their NFT as collateral and, in return, obtains a loan with terms mutually agreed upon. In the event of loan default, the lender may claim ownership of the NFT collateral. This approach enables NFT holders to unlock the value of their assets while retaining ownership and potential for appreciation.

Top players in the NFT lending market

Blend, propelled by its association with the leading NFT marketplace Blur since its establishment in May 2023, has exhibited remarkable dominance in the lending platform arena. As of March 2024, Blend commands an impressive 93% of the market share, with a staggering monthly lending volume totaling $562.3 million. Its ascent to prominence has been swift, initially capturing an 82.7% market share and consistently maintaining a dominant position, fluctuating between 88.8% and 96.5%. The first quarter of 2024 witnessed Blend's NFT lending volume surging by 49.2% quarter-on-quarter (QoQ), reaching an outstanding $2.02 billion.

Although Blend leads the market by a considerable margin, smaller players such as Arcade and NFTfi also hold noteworthy positions in the NFT lending sector. Arcade secures a 2.8% market share, boasting a lending volume of $16.9 million, while NFTfi closely follows with a 2.2% market share, generated from a lending volume of $13.3 million as of March 2024. Despite their smaller market shares, both Arcade and NFTfi have demonstrated resilience, maintaining over 1% in monthly market share since the preceding year.

In the first quarter of 2024, Arcade achieved a significant milestone with its NFT lending volume soaring to a record-breaking $39.4 million, marking a substantial 37.1% increase quarter-on-quarter (QoQ). Similarly, NFTfi experienced notable growth, witnessing a remarkable 48.3% QoQ rise, with its lending volume reaching $35.8 million. As Arcade initiates its recent token launch and NFTfi anticipates its forthcoming token release, industry observers are closely monitoring their impact on lending volumes.

Additionally, other NFT lending platforms, including X2Y2 (X2Y2) and BendDAO (BEND), each command a 0.8% market share, while Parallel Finance (formerly ParaX) holds 0.5% of the market.

The momentum in the NFT lending sector is palpable, as evidenced by January 2024's record-breaking monthly NFT lending volume of $900 million, surpassing the previous peak recorded in June 2023 at $850 million.

Ethereum NFT collections remain the primary collateral for loans, benefiting from the synergy between Blend and Blur. However, the rising popularity of Bitcoin Ordinals introduces a new dynamic to the NFT lending market's future trajectory, adding further complexity to industry trends and forecasts.

Also read: How to Claim, Access and Transfer NFTs from your ArtZone wallet

The Bottom Line

The driving force behind this trend can be attributed to long-standing NFT holders. These individuals or entities have retained their unique digital assets for an extended period, witnessing their value surge over time. However, accessing this value can be challenging, particularly if they are reluctant to part with their NFTs.

That’s where NFT lending comes in, by using their NFTs as collateral, holders can unlock liquidity, enabling them to participate in the market without relinquishing ownership of their prized assets. This trend is expected to persist as an increasing number of NFT holders seek avenues to capitalize on their holdings.