CEO Cz Resigns after Pleading Guilty & Binance Hit with $4.3 Billion Fine!

In a landmark case that underscores the growing regulatory scrutiny in the cryptocurrency industry, Binance, the world's largest crypto exchange by volume, has been slapped with a staggering $4.3 billion fine. This comes after a multiyear probe by U.S. authorities into the exchange's alleged involvement in illegal financial activities, including transactions linked to the organization Hamas.

Early Days and Rapid Growth

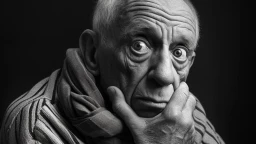

Binance's journey began with its founding by Changpeng Zhao, also known as "CZ". It quickly gained traction in the crypto world, becoming renowned for its diverse range of cryptocurrencies and innovative trading features.

The Road to Controversy

The roots of Binance's troubles can be traced back several years, to when the cryptocurrency exchange first gained prominence in the digital currency market. However, this rapid growth brought with it scrutiny from financial regulators worldwide. These included accusations of facilitating money laundering and enabling transactions for sanctioned entities. The most serious of these was its alleged involvement with Hamas, leading to heightened scrutiny from U.S. and international authorities.

The Multi-Year Investigation

The $4.3 billion fine is the culmination of a multi-year investigation by U.S. authorities into Binance's operations. The probe delved into the exchange's internal controls, anti-money laundering measures, and compliance with international financial regulations.

Mounting Legal Challenges

As Binance's influence grew, so did the attention of regulatory bodies. The exchange faced various allegations, ranging from facilitating money laundering to enabling transactions for illicit activities. One of the most damning allegations was its purported connection with Hamas, a group designated as a terrorist organization by multiple countries.

The Climactic Settlement

The culmination of these legal challenges led to a groundbreaking settlement with U.S. authorities. As part of this settlement, Binance agreed to pay a $4.3 billion fine – a record-breaking amount in the crypto industry. This fine was a direct consequence of the company's admission of guilt to charges of money laundering and other financial crimes.

Leadership and Structural Changes

In a move reflective of the gravity of the situation, Changpeng Zhao stepped down as CEO of Binance. This leadership change is part of the broader restructuring effort by the exchange to realign with regulatory expectations and salvage its reputation.

The company said Zhao has been replaced by Richard Teng, a senior Binance executive who joined in 2021.

Current State and Industry Impact

As of now, Binance is navigating through the aftermath of this settlement. The fine and the leadership changes signify a pivotal moment not just for Binance but for the entire cryptocurrency industry. It highlights the increasing importance of compliance with financial regulations and the potential consequences of oversight.

Investors have pulled around a billion dollars in the past 24 hours following the announcement of the CEO stepping down. The crypto world is closely watching how Binance remodels its operations and governance in the wake of these developments. This case serves as a stern reminder to other crypto exchanges and digital asset companies about the importance of adhering to legal and regulatory standards.

Also Read: How to turn yourself into an Anime Character using Midjourney?

This ongoing saga with Binance is a clear indicator of the maturing landscape of the cryptocurrency market, where regulatory compliance is no longer an afterthought but a cornerstone of operational integrity.